There are options when we talk about stockpiling wealth or currency in preparedness folds. Precious metals (PM) as a preparedness item are a topic of some debate in and of themselves, with Suisse bars a love-hate or what? item inside the genre of unconventional currency. Some collect their PM’s in various forms of “junk” coins or bar form for the ease of acquisition and recognition value. Some collect gems instead, pointing out the number of immigrants who have arrived in various countries with fortunes in the linings of their clothing and the even more condensed form of wealth they offer. Some choose to go with keeping paper cash on hand, with the expectation that once cash is truly meaningless, there are other barter items available or it’s time to batten down the bunker hatches and compound gates and ride out the storm. There are others who point out various regional currencies as a way to hedge against loss.

Precious metals are sometimes maligned, with anti’s pointing out the bubbles involved with them and the amounts they’ve “lost” here and there with purchases. Many will also point out that you can’t eat a coin or sapphire.

Those anti’s are right.

You can’t eat a sapphire or coin, can’t use it to treat an infection, can’t wrap up in it to keep warm or use it to stitch up a torn udder. You also can’t immediately swipe them in the case of an emergency room visit to save a farm dog’s life at 3 a.m., even now. There are absolutely highs and lows in the value of gold and silver – like buying a house, there’s no guarantee that the value will go up.

One of the things we commonly hear about buying the precious metals deals with the larger weights, 50g and 1-oz. or more – the $20, $50 or $100 loaf of bread or can of beans argument. That can get thrown away, regardless of whether we go with coins or bars of one kind or another. There are both coins and bars that represent smaller amounts.

I don’t personally see precious metals (PM) as an investment with intended returns over purchase price. Instead, I see PM as another form of insurance, as an alternative to paper or an electronic balance. Certain things have had value since at least B.C. time-stamps, and PM’s and gems are among them even when a printed currency fails. They are a standby through most of the world and most of history.

Assign priorities

Even so, PMs are not and will not ever be my sole focus. Because we aim for different lengths of times and have different expectations and abilities, our priorities and what we focus on are going to be different.

Before we delve into precious metals (or anything – 5K rounds of ammo, 600 pounds of wheat, biodiesel big rigs) we should sit down and seriously consider what we are preparing for, why, and how much we can spend. I personally think immediate needs and existing debt should carry equal weight, but others will say max everything to get as many physical goods as you can and some will push to escape high-interest debt before moving beyond a standard hurricane, tornado or any other evac or shelter-in-place kit.

Lists are important in prioritizing. Listing with a firm eye toward wants and needs can help both in creating available budget and spending it wisely. Don’t assume you won’t reach retirement age without a mega disaster and that you’ll never need to pay health insurance and medical co-pay when you’re making your lists – include that additional savings and investment in your needs.

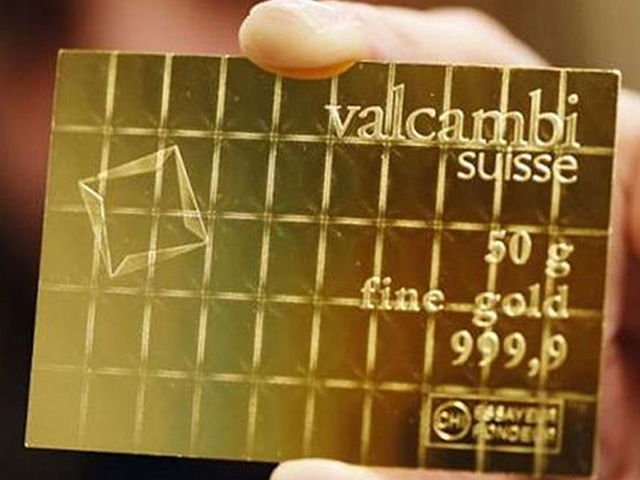

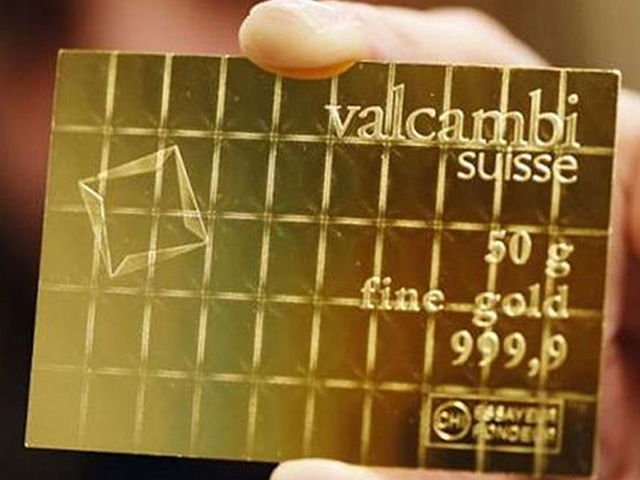

Suisse bars

When we’re ready to branch into backup currency, a lot of us hear about and jump on coins. I’m not totally against coins, but I don’t go that way exclusively or in a big, big way. I’m not jumping on the gem bandwagon, either. I kind of like Suisse bars.

Suisse bars are a type of bullion that come in thin sheets, regularly encased in plastic. There are now some that come in a break-away format that allows you to snap off small segments for smaller purchases or cash redemption. They are available in many several metals, but for our purposes, silver and especially gold suit my needs.

The gold bars come in pretty useful chips or little bars of 1, 2, 2.5, 5, and 10 grams, stamped with their weight and their purity, with an enclosed certificate when purchased from a respectable dealer. Those weights fluctuate in price, as gold pricing goes up and down, but are typically in the $40-50, $70-80, $90-120, $200-220, and $400-450 ranges at the moment, respectively. The smaller the denomination purchased, the greater the pricing markup, usually. However, there are those new-ish 20- and 25- and 50-gram divisible or “combibars”, such as JM Bullion and Austin Coins. Because of their specialty, they’re usually more expensive than if we’d purchased a solid bar.

Since I don’t often make thousand-dollar purchases, I usually skip the 20-gram and larger gold bars, just like I don’t delve into 1-oz. gold coins all that often. Smaller denominations cost me a little more now, but have more applications in any future.

Suisse bars are available for silver as well. Obviously, the value of silver is lower, so in some denominations, the ease of calculation is the only real benefit over a coin. However, they can help fill gaps between the greater values of gold coins or gold Suisse bars for purchases in the future.

Suisse bars versus coins

I consider a 5-oz. silver Suisse bar a lot more convenient than a specialty coin or roll of coins that total $100-120 in silver. I do have some silver coins, but as I move forward in life, I like the Suisse bars more and more.

When I get paid for a job, it’s sometimes in junk silver or oddball smaller gold coins. Since I don’t carry knowledge of all things in my head, I have to not only know the current spot price (which means a newspaper or the internet), but also each coin’s worth, the amount and purity of the PM in that coin. For me, that means some printed cheat sheets or a book.

The first time somebody showed up with a Suisse bar and asked how I felt about barter instead, my eyes opened. Now, since the bar itself and the stamp inside each little plastic credit card tells me the weights and purity, it’s super easy to do math using only a single sheet of reference for that spot price. I also don’t have to check to make sure those coins are all the appropriate silver-content without an “oops”, and the Suisse bars are easier for me to redeem than waiting for the coin guys to be there or to inspect each one in turn. Easy transactions are a good thing.

Now consider what I have to carry if I’m the buyer with junk silver and 1/10 gold coins.

I don’t commonly go to a store or go do a job for less than $20, and regularly, it’s a $40-50 trip. I rarely leave a supermarket without spending $50-100 and I have never had a service person out for less than $100. That means some of the 1- and 2-gram gold and the 20- and 50-gram silver Suisse bars very much have a place in my current spending.

Since we typically talk about the loss of value on the dollar, too, I can expect that a current $1-4 loaf of bread or apple fritters will go up, too. So I really might not have much use at all for those $2-10 denominations, anyway. Sure, some, maybe, so I can still get a cup of coffee and a meal while we’re in town, and tip the waitress (we’ve been exchanging metal bits for meals since the Dark Ages – it’s okay to envision it, honest). But I expect that if I ever fall back on them, modern society or knocked-back, knocked-down culture, those equivalents of today’s 20’s and 50’s will see a lot of use.

I need my book, really, because not everybody is going to trust a printout. I need the printout (or somebody’s declaration of spot price per ounce). And I need my assorted coins. Maybe I’m going to a pawn shop or bank to sell them for a mortgage or Buy’N’Large-appropriate cash, maybe a government is reestablishing or it’s a disaster more like the Civil War, Great Depression, Argentina, Bosnia, or Greece and I need to pay taxes on my property. Maybe I’m off to buy myself a new donkey or mule, and, hey, while we’re out, hit the blacksmith for a new file or hitch bar, or a septic man to come check my system. I’d like to be able to work in relatively small amounts like $20, $40, and $100, but I may also want to deal with $500-$2K.

With Suisse Bars, I can fit several thousand dollars flat on my person inside a belt, inside the lining of a vest or coat, inside my holster, and inside two or three pockets.

With Suisse Bars, I can fit several thousand dollars flat on my person inside a belt, inside the lining of a vest or coat, inside my holster, and inside two or three pockets.

Suisse bars – especially in conjunction with some coins for $2-10 purchases – give me that flexibility, and I can fit several thousand dollars flat on my person inside a belt, inside the lining of a vest or coat, inside my holster, and inside two or three pockets. I need just that spot price, whether I print it weekly or cut it out of a paper and stash it monthly, and that fits nice and flat, too. They add some weight to a canteen, to the stiff panel of a holster or mag pouch, but they don’t add a lot of bulk and they don’t add the weight of 1925 dimes or 1943 quarters.

Compared to just the coins, the Suisse bars do take up more space due to the packaging, but that packaging is what allows them to be readily used as currency and barter even with people who aren’t currently preppers and who are going to be suspicious of the junk silver we like unless we present – and sometimes even with – a “real” book that shows their silver or gold value. The lack of trust may end up limiting our future options. The book alone is one more thing that I have to carry around, or I may end up losing more opportunities from non-hoarders. Since we like to do things in three around here, it’s not just one book or one set of cheat sheets.

Anything limiting is bad. Options are good.

I’d like to be able to use them pretty easily. Marked as they are, Suisse bars inspire a fair bit of confidence in recipients and come with an ease for calculation, use, and carry that coins or rolls of coins just don’t. Not for me.

Suisse bars versus gems

Something I see come up regularly when we talk about PM’s on forums or in person, is that soul who points out gems. It’s a point I acknowledge. However, when you start talking about gems you need three things: a knowledgeable buyer, tools for assessing value, and to be spending a fair bit at once.

You’re way past a how-to book for the uninitiated with even small diamonds. You’re into a loupe, and you have to find somebody willing to take them. If we run into the “you can’t eat a coin” mentality when we discuss PM’s, that goes double for the stones folks. Fewer people will just take your word for it on the value of a piece. A certificate for a stone or a piece of jewelry isn’t going to carry all that far, really, unless somebody can find a jeweler to confirm that value. There’s more time, more equipment, and more specialized skills needed to use gems as currency.

Now, if the Bad Thing that happens turns us into refugees fleeing into a working, functional country and city, my theory is dumb. Somebody with some nice, rare stones and gems stuck in the hollowed out chunks of their boot heels, grandma’s cane, and Cousin Louie’s hood seam are going to be able to readily find a shop, trade their gems for monies, and go be successful. I’m going to have a harder time stashing the same cash value worth of <5g Suisse bars than gem people or people with 1-oz. gold coins.

That’s a pretty specific scenario, though. Because they’re more versatile through more disasters of lesser and greater scales, I prefer the Suisse bars.

Buying in

There are some real scams out there associated with Suisse bars, especially. There are some stupidly overpriced coins, too, but because of the packaging, Suisse bars end up seeing a lot of markups and some unsavory types will always take advantage of wants, needs and fears and mark things up further.

Do your homework. Always.

A three-minute internet search can give you the going rate of bars and denominations, their shipping costs. That knowledge can be carried to a supplier (remembering that brick-and-mortar shops pay for overhead and that increases the price further). We can also call around to shops before we even go out the door so we know what a general starting price is for our areas and not be taken advantage of by unscrupulous types in our towns and cities, or plan a detour to buy from a larger supplier in a larger town somewhere, where bulk consumption helps keep consumer prices lower.

If you choose to buy online instead of with cash, for sure and 100% at least compare the prices against a reputable dealer like JM Bullion or APMEX, and be really, really sure Amazon and eBay are going to insure your purchase and the shipping. Do a BBB and internet search for the seller and company to find reviews. If they’re not 5-star sterling, buy elsewhere.

Suisse bars as a currency

The sizes and ease may make Suisse bars part of a solution for somebody who’s ready to invest in more than savings, retirement, and consumables. They aren’t for everybody, and neither are PM’s. I don’t believe in a one-size-fits-all fix for anything in life, really. But they are an option for backup or alternative currency, and they’re one I rarely see discussed (besides the scam alerts) so I wanted to point them out.

There are options when we talk about stockpiling wealth or currency in preparedness folds. Precious metals (PM) as a preparedness item are a topic of some debate in and of

Can you fish in SHTF? Fish and the problem with a source for Omega 3 mainly goes away.

Can you fish in SHTF? Fish and the problem with a source for Omega 3 mainly goes away.

Hand tools are important, but if I can use a chainsaw, I will.

Hand tools are important, but if I can use a chainsaw, I will. You would use anything other than batteries for lighting? Sure I would, with caution. I have some

You would use anything other than batteries for lighting? Sure I would, with caution. I have some

With Suisse Bars, I can fit several thousand dollars flat on my person inside a belt, inside the lining of a vest or coat, inside my holster, and inside two or three pockets.

With Suisse Bars, I can fit several thousand dollars flat on my person inside a belt, inside the lining of a vest or coat, inside my holster, and inside two or three pockets.

A urban survival kit can give you the survival items you need to make it out of the city fast.

A urban survival kit can give you the survival items you need to make it out of the city fast.

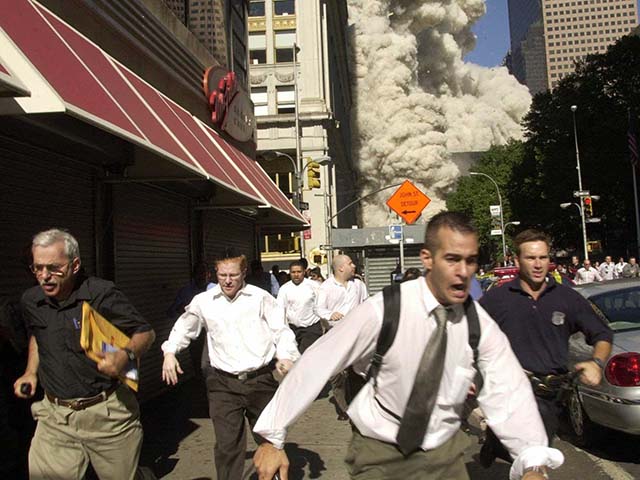

In a disaster or crisis you could find yourself running for your life. Will you have the gear you need?

In a disaster or crisis you could find yourself running for your life. Will you have the gear you need?

Rush 24 by 5.11 Tactical

Rush 24 by 5.11 Tactical

Plan multiple routes you can take away from school back to safety and a communication plan with family.

Plan multiple routes you can take away from school back to safety and a communication plan with family.

European Yew is suggested as the best material for making bows, but good old Hickory is great also.

European Yew is suggested as the best material for making bows, but good old Hickory is great also.

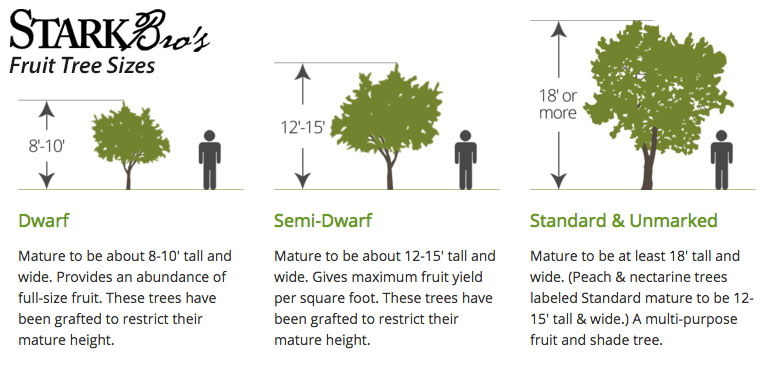

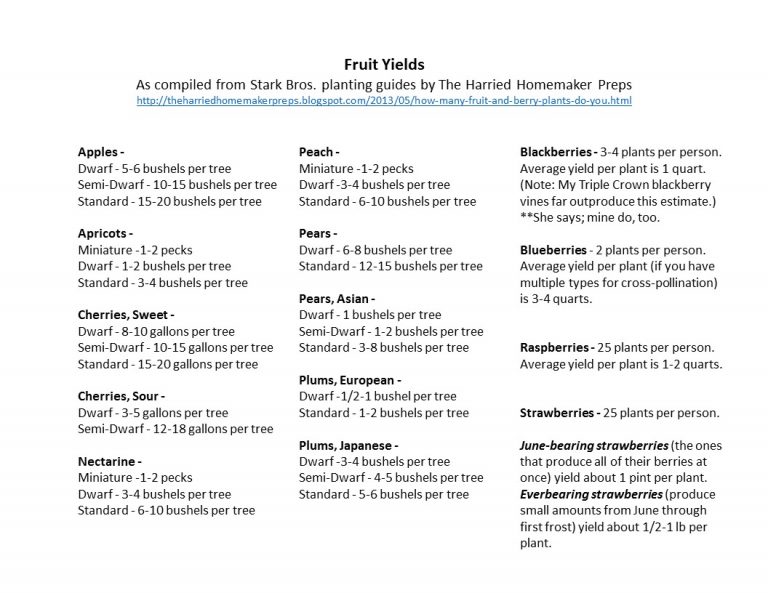

Dwarf and semi-dwarf trees produce the same type and size fruit as standards, just less per tree.

Dwarf and semi-dwarf trees produce the same type and size fruit as standards, just less per tree. Be aware: Yields vary depending on soil types, nutrients, water, pests, pruning and variety of tree within each species. I halve the numbers from Harried Homemaker and Stark Bros. when presenting estimated to clients.

Be aware: Yields vary depending on soil types, nutrients, water, pests, pruning and variety of tree within each species. I halve the numbers from Harried Homemaker and Stark Bros. when presenting estimated to clients. Cordon or columnar fruit is available in several species, and while expensive, it can save space to increase diversity and allow homeowners variety and resilience.

Cordon or columnar fruit is available in several species, and while expensive, it can save space to increase diversity and allow homeowners variety and resilience. Dwarf, container, trellis and espalier fruit can transform a compound into a more pleasant space, allow perennial production in urban and suburban environments, and let us take our fruit trees and shrubs with us when we move.

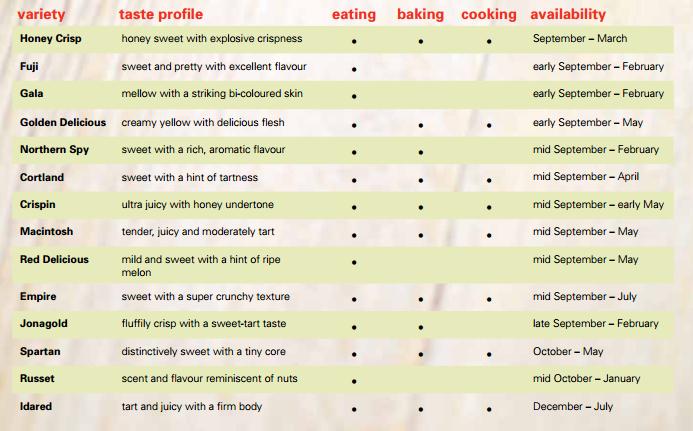

Dwarf, container, trellis and espalier fruit can transform a compound into a more pleasant space, allow perennial production in urban and suburban environments, and let us take our fruit trees and shrubs with us when we move. Increases harvest season – One benefit to smaller trees is that we can spread out the harvest season. The common standard tree yields of 10-20 bushels is a lot to deal with inside the 1-3 weeks of the harvest season for each variety, and once it’s in and processed, there’s no more fresh fruit. Instead, we can tailor our home orchard for 3-6 months of fresh produce by selecting varieties from late, mid and early seasons within their species and having a couple of other species with them.

Increases harvest season – One benefit to smaller trees is that we can spread out the harvest season. The common standard tree yields of 10-20 bushels is a lot to deal with inside the 1-3 weeks of the harvest season for each variety, and once it’s in and processed, there’s no more fresh fruit. Instead, we can tailor our home orchard for 3-6 months of fresh produce by selecting varieties from late, mid and early seasons within their species and having a couple of other species with them.

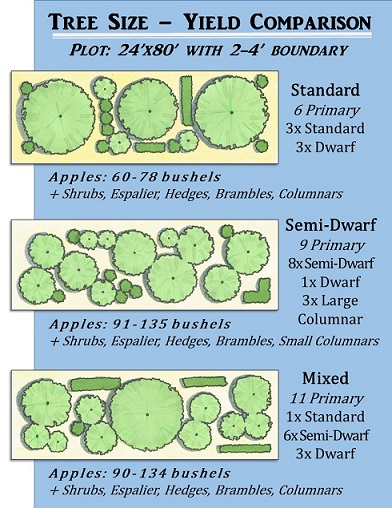

Smaller trees can allow us to increase variety and resilience in the same space. If one species, variety, or specimen is lost or damaged by pests or weather, others may survive.

Smaller trees can allow us to increase variety and resilience in the same space. If one species, variety, or specimen is lost or damaged by pests or weather, others may survive. Graphic: Using a mix of semi-dwarf and dwarf trees can increase the total fruit yield in a space as well as create resiliency. *Yield estimates taken from Harried Homemaker Preps’ compilation of Stark Bros. estimates.

Graphic: Using a mix of semi-dwarf and dwarf trees can increase the total fruit yield in a space as well as create resiliency. *Yield estimates taken from Harried Homemaker Preps’ compilation of Stark Bros. estimates. Dwarf and espalier fruit can be trained to hedges, serving multiple functions on our property as well as producing food.

Dwarf and espalier fruit can be trained to hedges, serving multiple functions on our property as well as producing food.