Decentralizing Cash – The Ultimate Survivalist Preparation

If the catastrophic event you’ve been preparing for does one day come about, it will be a fearsome test of your survivalism. Like any test, some will not pass. But in this case the consequences for valued loved ones might be heart-rending. Preparation may be the answer, but whether it’s civil war, war with a foreign power, economic collapse, or social unrest, centralized money will have in one way or another been the root cause. Because whatever the event that tears apart the fabric of this country, the policies fueled by our fractional-reserve banking system-inflated fiat currency, and its petrodollar role, will certainly have taken us there.

Individual interests tend to focus in different directions than centralized ones. There are few parents, for example, who if given a choice would elect to have their children go hungry, thirsty, sick, or uneducated so they could spend money-making war with their neighbor. Their interests are naturally aligned to prioritize the well-being of their children. In a centralized government the vast majority of decision-making power does not rest with us or the people around us. In the absence of this authority decisions must by necessity follow money. And wherever the money is, whether it is in governments, corporations, or private individuals, if it is not with us it is always by definition aligned separately from our interests.

Through currency inflation, centralized money is not only then a means of extracting wealth from all who use it, but also a tool to further the interests of the centralized entities controlling it. Because money naturally moves public policy and broad societal and cultural changes in the direction in which the money flows; like an irresistible tide. There will of course be broad patterns to the directions that the flow of corporate money causes both popular culture and public policy to move in. Centralized money will flow towards policies and social changes that lead to the further centralized accumulation of money. A broad swath of society drifting with this current will move with amazing synchronicity, as if connected to invisible strings all pulled by the same hand. In the bigger picture, compared to this centralization, the leader, party, or system of government you believe you are electing may not even matter. It doesn’t have to be a conspiracy. Every act of this centralized tide of money will be in its own interest. That power will centralize this way should not be hard to imagine. It’s already doing so.

Decentralized money is a key part of any model capable of ensuring a better alignment between the decision-making process and individual interests, the alignment that best ensures a tangible focus on the well-being of the people and environment immediately around us. This may seem like a radical idea, but it was only this century that bank promissory notes (in effect a type of currency issued by each bank) gave way to the centralized Federal Reserve system.

This finer point of decentralizing cash among different currencies is often lost. Though currencies like Bitcoin may be decentralized in their technical operation, they are still single currencies that permit one individual’s stored value to be speculated away by another person who did not earn it. They are still a means of wealth extraction.

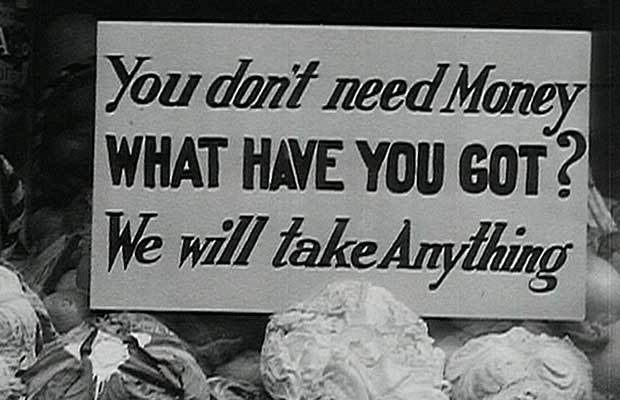

A truly decentralized system of currency carries its value around with it independently of the guarantee of any centralized entity or of any single network to uphold that value. Gold and silver are options of course, but gold is heavy and having the waiter at your favorite restaurant divide your gold bar into change is inconvenient.

Technology may soon come to the rescue, enabling individuals to store and exchange value using a sophisticated system of IOU exchange in which value is stored in terms of IOU contracts held between members of the community. Such a system would track the collective collateral of the community, using that aggregate value to back the value of an IOU between two parties so that value can be transferred to a third. This system will allow the value of the currency to be guaranteed by the community itself as a whole when trading externally. During actual physical exchange the existence of sufficient collateral to cover an IOU document could easily be verified. In the absence of a telecommunications or other network the recipient will simply choose whether or not they trust the certificate embedded into the IOU, and whether they trust the community that issued it before deciding to accept the IOU as payment in a transaction. Like we do now.

These IOUs will of course be documents you can print out. But imagine they look like dollars. And the certificate of authenticity from your community, the community guaranteeing the value of the IOU … imagine that certificate looks just like the fraud protection features of the dollar. And finally, imagine that your signature is a serial number. All of this brings us to a pretty counter-intuitive realization. The ideal system of currency is printing your own money.

Printing your own money is a key part of the peer-to-peer, decentralized, user-centric, and collaborative economy we’ll have to depend on to create stable prosperous employment that can survive a currency collapse.

How specifically will a peer-to-peer, decentralized, user-centric, and collaborative economy serve your local community?

- Design of products for local manufacturability by unskilled workers will create a more inclusive economy.

- Design to allow for operation in areas disconnected from any infrastructure will create more equitable development.

- Injustice results when demographics are under served. Key requirements of massive collaboration are algorithms that harvest the collective wisdom and motivations of groups. Collaborative motivation algorithms will identify the most powerful interests of each demographic to align services with their collective interests. Collective intelligence algorithms will quickly identify the most effective services to achieve those interests for each demographic. After identifying the most effective services for each demographic, peer-to-peer, user-centric, decentralized infrastructure would enable separately customized services to be deployed regardless of infrastructure limitations, thereby best serving the needs of each individual in each demographic.

- In addition, we need to simplify work and simplify collaboration in ways that lower the bar to involving more people in internships and other training programs, as well as simplify the deployment of business models for collaborations that allow participants to earn a living wage. This will benefit all demographics through, for example, making education more effective, cost efficient, and accessible, through the creation of job opportunities, and through increased access to services like health care.

With this blueprint, independent communities can quickly build all the services they need in a way that’s customized directly for them, and that prioritizes their own family and loved ones rather than the interests of centralized bureaucracy that undermines their needs.

In this article I’ve laid out a vision for taking back control of a country that’s gone way off course. For me, this vision was one that demanded to be shared. As part of the audience who understands the magnitude of what may be coming, if this vision inspires you, take the opportunity to share and inspire others as well. Some of them just might be the makers who dream big enough to build it. The blueprint is there. The next step is yours.

If the catastrophic event you’ve been preparing for does one day come about, it will be a fearsome test of your survivalism. Like any test, some will not pass. But

Another good reason to keep an empty fuel tank in your car. Carol is always prepared…

Another good reason to keep an empty fuel tank in your car. Carol is always prepared…