People have been saying the US is on course for an economic collapse for years; however, many of them have no formal education in economics, and almost all gain financially from promoting stuff that would help others weather such a calamity. I decided to research the opinions and publications of economists who were ideologically centered, were not benefiting financially, and understood the country’s true fiscal condition, and tried to provide an estimate of the most likely future economic situation of the US. The future does not look bright. Several economists anticipate the US will default on its debt if the country does not change its fiscal policies.

Two major factors are driving this conclusion. The first is the size of the US debt. According to economists, the government has been misleading the public on the size of the debt through poor accounting practices and using misleading terminology in certain fiscal activities. In 2013 the debt was at least 91 trillion.

The second factor is that the US will never be able to repay the staggering debt because of changing demographics. The American population is aging, and most economists agree this will have a deleterious effect on the economy. Decades of abortion and birth control is resulting in increasingly smaller numbers of working age people. Consequently, the government will collect much less revenue from income taxes. Meanwhile, the dependence on the government for medical care and Social Security will continue to grow. Most other developed countries are in the same situation – staggering debt and decreasing numbers of working age people. If the US significantly defaults on its sovereign debt, a worldwide depression is very possible since national economies of the modern world are complexly interconnected. Regardless if the US defaults or not though, we can expect higher taxation, loss of government services, higher inflation, and slower future economic growth. In my estimation, the best way to prepare for all this will be for people manage their finances so they can pay their bills and survive with income from minimum wage jobs. The future economy of the US is almost guaranteed to be poor.

Empty shelves in Mexico

How bad is the risk of economic collapse?

Highly respected financial experts agree that the US is far deeper in debt than what the government officially reports. In Feb 2015, Dr Laurence Kotlikoff, an economics professor from Brown University and former senior economist on President Reagan’s council of economic advisors, testified to the Senate Budget Committee that US debt is far greater than the government’s official tally, and the government has deliberately misled the public about the real size of it for years. He testified that the government had been using Enron style accounting and misleading semantics to mask the size. According to Kotlikoff, the government’s current 20 trillion debt is only a fraction of its fiscal obligations. It represents the amount of money the government has borrowed only. It does not account for other current and future obligations the government must pay such as Social Security, Medicare, Medicaid, government pensions, and other expenses.

According to Kotlikoff, the fiscal gap between what the government must pay both now and in the future and what the government is projected to collect in taxes and other financial means amounts to 210 trillion. He also spoke at length about how the government uses semantics to mask borrowing. He used Social Security funding as one example. The government does not term transferring Social Security funds from current taxpayers to pay current retirees as borrowing; however, this has the same effects economically as any other type of borrowing. The government will have to repay current taxpayers when they retire and become entitled to Social Security. According to Kotlikoff, if the government were to re-label this and other transfer of funds as borrowing, then the government would have to report the debt to be 210 trillion. Most Americans are unaware of this, yet they will pay a cost for these financial obligations irrespective of whatever terminology the government uses.

Another economics expert, Jangadeesh Gokhale, conducted research on this independent of Kotlikoff, and his conclusion supports Kotlikoff’s argument; however, Gokhale came to a more modest estimate of the debt size. Gokhale, a former senior economic advisor to the Federal Reserve Bank of Cleveland and member of the US Social Security Advisory Board, conducted an analysis in 2013 and estimated the real size of the debt to be 91 trillion. Kotlikoff and Gokhale came to vastly different numbers because of different baseline assumptions, different datasets, and different fiscal projection time frames. The public fiscal liability is far larger than what the government has led us to believe.

Jeffrey Hummel, an economics and history professor from San Hosea State University, argued in 2012 that the government would default on its debt as a result of this. In a publication in Econ Journal Watch, Hummel argues that regardless if the debt is 79 trillion (Gokhale’s and Smetter’s 2006 estimate) or 210 trillion, the most likely outcome is that the government will be forced default on its debt. According to Hummel, there are two obstacles currently preventing the calamity. The first is the ability of payroll taxes to fund Social Security and health care programs (Medicare Part A). When the trust funds for these programs are deleted and payroll taxes can no longer fund them, the government will have to obtain money from other areas. Hummel believes that at this point, investors will begin to require a risk premium on Treasury Bills, and the cost for the US government to borrow money will increase. This will exacerbate the government’s financial situation and cause investors to require even more risk premium. The second obstacle is between currency and debt repayment. Hummel believes the government will allow inflation to depreciate the value of currency until it reaches a tipping point when the government will have to choose between allowing currency become almost worthless and defaulting on its debt. Hummel believes the US will choose to default. Part of his reasoning comes from history. Hummel suggests America will do what the former Soviet Union did in the 1990s which was to choose a partial repudiation of its debt. Hummel argues that the default will be rapid when the US reaches its tipping point – very much like the speed at which the Soviet Union defaulted. There are other factors which could cause a tipping point; however, these are Hummel’s two prime ones. He estimates that the default will happen sometime within the next two decades. A pessimistic view is that health care program funds will be depleted as soon as 2017, and the tipping point could be reached then.

Publications and opinions from other economists support Hummel’s contention. Gokhale supports this conclusion in his monograph, The Government Debt Iceberg. In the forward to it, Phillip Booth, the Program Director of the Institute of Economic Affairs, states that if no adjustments to the current fiscal situation are made, then “sovereign defaults on explicit (Treasury) debt and implicit pension liabilities must ensue.” Kotlikoff testified that to prevent the default, the government must immediately and permanently raise income taxes by 60% or cut spending by 40%. Most would agree this is politically unimaginable. Consequently, Kotlikoff believes that it is not a question of if the system will collapse but when. The idea that the US will default on its debt comes from several well-respected economists.

What would a default mean?

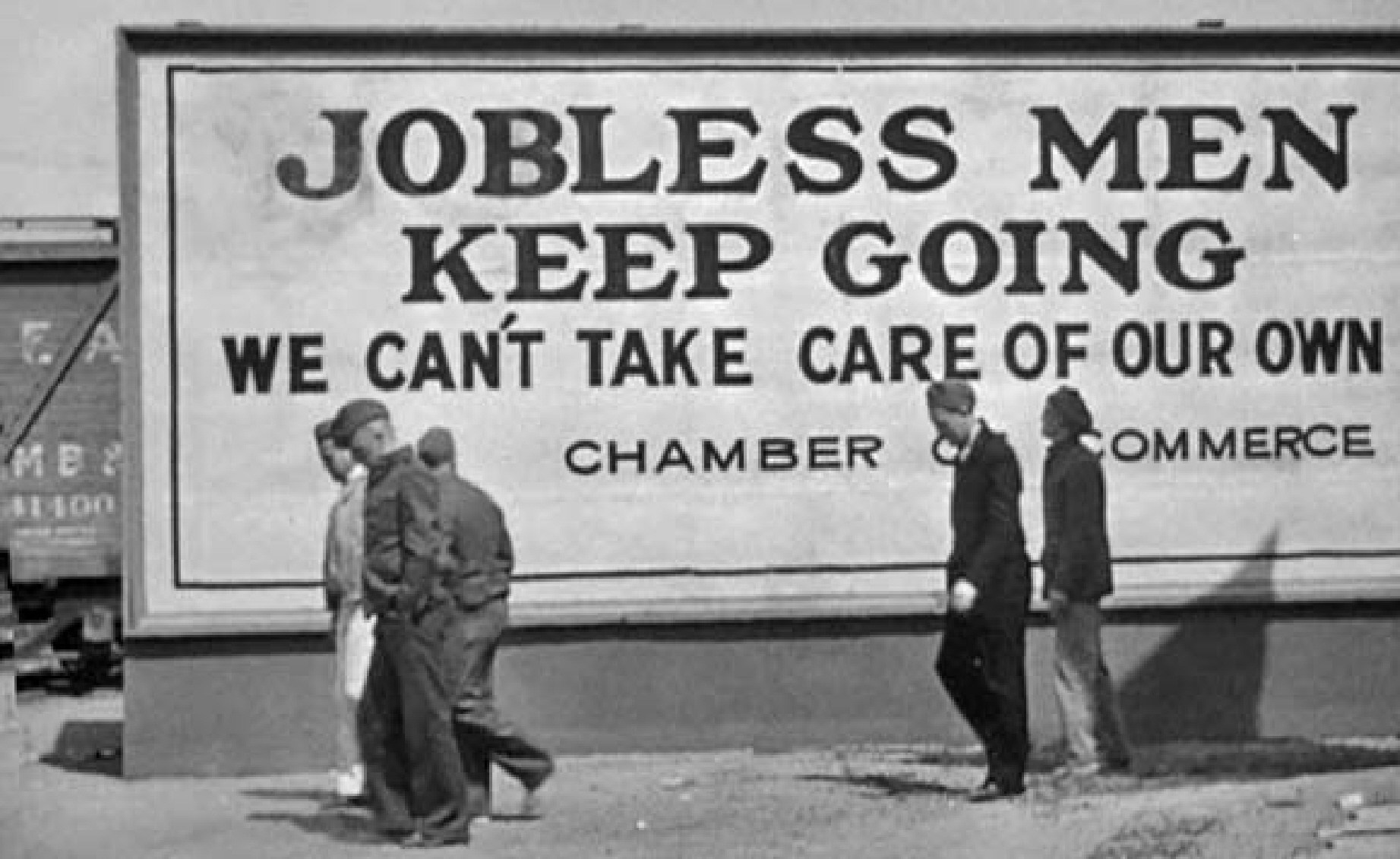

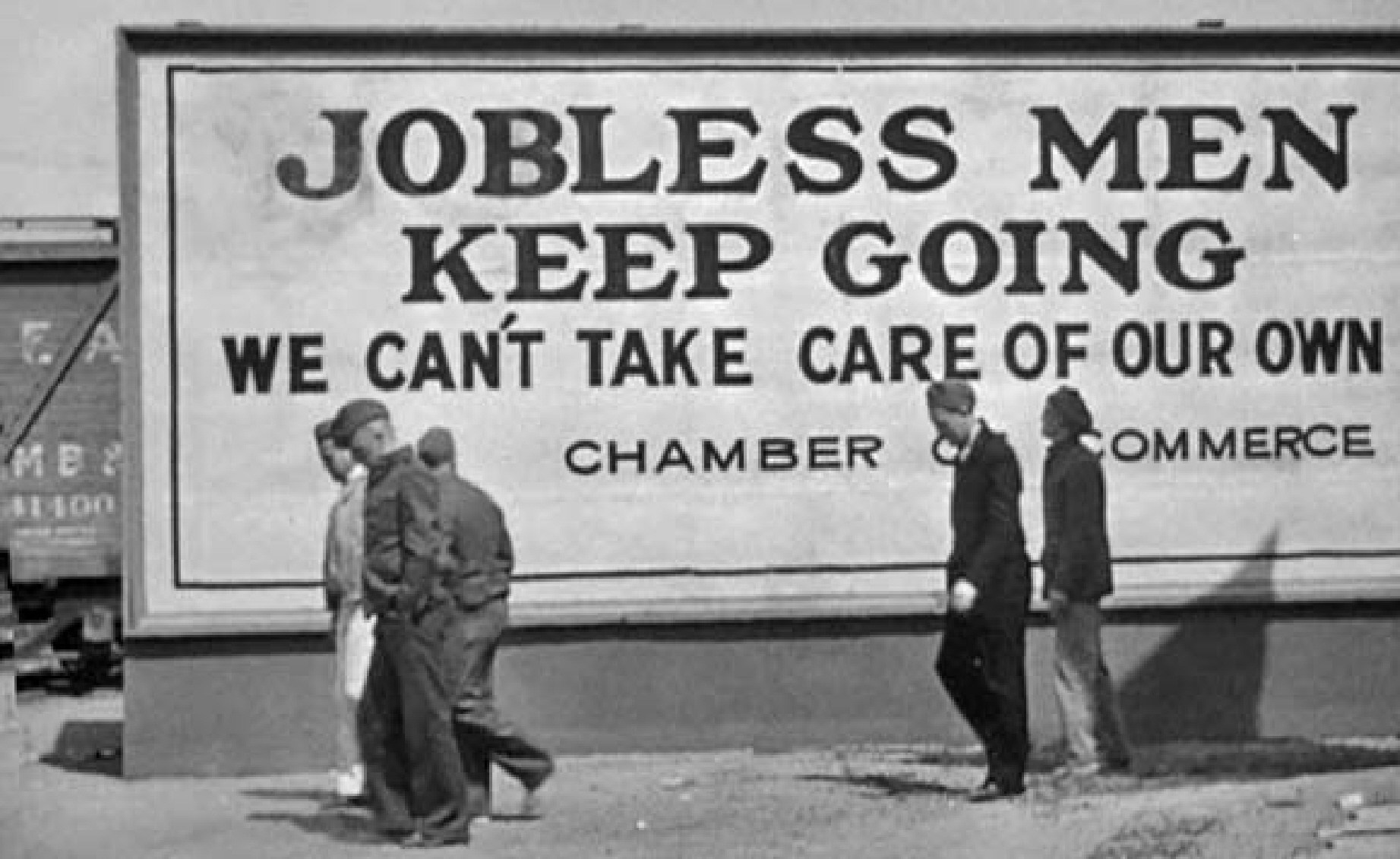

It is safe to say that a significant default on the explicit (Treasury) debt, which currently stands at 20 trillion, would have severe repercussions throughout every aspect of the US economy. A few years ago, Congress threatened to allow the government to default rather than raise the debt ceiling, and news agencies interviewed financial experts to find out what effect this would have on the economy. Bloomberg News interviewed dozens of money managers, economists, bankers, traders, and government officials in an attempt to answer to this, and most saw a US default as a financial Armageddon which would very possibly result in a worldwide depression. NBC News interviewed financial experts and identified seven likely consequences to a default on government debt. The first and worst consequence would be a worldwide depression and unemployment as financial shock-waves spread through the economy. Second, there would be a massive sell-off of the dollar causing prices to rise on everything from groceries to gas. Interest rates would rise and decrease the ability to borrow. Third, US equities would lose value causing 401k values to drop. Fourth, Social Security payments would cease. The fifth impact is banks would freeze operations. According to NBC News, trillions in bank equity would be wiped out. Banks would not roll over loans and would demand immediate loan repayments. Since most small businesses pay their employees with rotating credit, many would not be able to retain their employees. Sixth, Money Market funds would lose billions of dollars. Every Money Market fund would be impacted. And seventh, the global markets would see major disruptions. Simon Johnson, former chief economist for the IMF, believes that no company in the US would be unaffected by a default. In an article in Slate, he wrote that the country would see massive unemployment and bank runs along with depleted savings and refusal to issue credit. Typically, news agencies try to dramatize news in order to attract viewers, and these opinions may be exaggerated. Even if they are only half-true, a default would be devastating. It would be a calamity.

The main reason the government will not be able to repay its debt is due to changing demographics in America as well as the rest of the developed world. America’s population is aging and there will be fewer working age people in coming years to support the older population. Since the development of the birth control pill and other modern means of contraception as well as legalization of abortion in the developed world, the number of younger people has declined. Normal age demographic distributions resemble a pyramid. The bottom of the pyramid is large and represents the numbers of very young people. The top represents numbers of elderly people, and it is small because as age increases there are fewer elderly. For the first time in human history, the demographic is shifting to an upside down pyramid where there are fewer young people at the bottom and larger numbers of elderly at the top. This holds true not only for America but China, Russia, Japan and most European countries as well. All developed countries’ populations are aging. Economists are not certain how this will affect economies since there are no historical precedents. The general belief is that it will slow growth. Of course, with the increase in elderly people there will be an increase in the number of people dependent on Medicare and Medicaid which will further drain government resources and deter its ability to repay its debt. Depopulation will be a major factor in our coming economic demise.

There are a few people who make counter-arguments; however, they are weak. One economist, Scott Sumner, does not disagree with Kotlikoff’s contention on the size of the debt, but he disagrees with Kotlikoff’s view that the country is broke. He makes the point that if the country were broke, the bond markets would have reacted negatively. He further makes the case that the courts have allowed the government to scale back the amount in Social Security payments, and suggests the government will do the same for this and other benefits. The problem with this position is that it does not consider the political power of the elderly. Currently, AARP represents and lobbies for about 50 million elderly people. Sumner makes an implicit assumption that there will be a younger population of taxpayers to fund the needs of the older generations. Another counter argument comes from Clem Chambers who is a writer, entrepreneur, and businessman. In an article in Forbes titled “Why Doomsters Who Predict the Collapse of Money are Wrong,” Chambers contends that the government will simply maintain inflation to reduce debt. His analysis is oversimplified and does not take into account many variables especially the depopulation factors and actual debt size. He provides no supporting data or mathematical model to prove his conclusion. He does not have any formal training in economics, and there are no economists that agree with his view. For Chambers, the answer is blistering simple – just let inflation eat away the value of the debt. Hummel believes that inflation will no more reduce the debt than an excise tax on chewing gum. Chambers appears to simply have dismissed the argument of collapse without applying much analysis. Another dissenting opinion comes from Joel Naroff, an economist from Naroff Economic Advisors. In an Oct 2015 interview with Consumer Affairs reporter Mark Huffman, he stated that “consumers are spending, firms that supply into the U.S. based economy are generally doing well and with wages rising and energy costs low, consumption should remain solid for all of 2016.” This was in response to questions about any coming economic collapse. He was speaking about the current and near-term US economy however. He didn’t address debt or depopulation in any of his statements. There are few, if any, counter-arguments which include depopulation or the 91 trillion debt in their analysis.

So what will the future be like?

All economists agree that no one really knows, but there is strong probability of a few things. We can expect high inflation. Governments create inflation when they print more money to pay down debt. Both Kotlikoff and Hummel agree that the government will not be able to significantly repay debt through inflation. Hyperinflation is not likely. Hyperinflation historically has been the result of a combination of a sudden expansion of the money supply and a weak central government which cannot collect taxes or make budgetary reforms. It is associated with war, deep civil unrest and civil war. The US government certainly has no problems collecting taxes, and there are no economists currently predicting hyperinflation; however, Kotlikoff commented in a television interview that the groundwork prepared for it. We can expect increased taxation to pay for entitlements. It is very possible we will see wealth taxes. With reduced working age people, the government will seek to replace the loss of income tax revenue with another form of taxation. The government will likely increase taxes on IRA withdrawals. We can expect fewer jobs because as the number of consumers decreases, the more businesses will fail. According to Carmen Reinhart and Kenneth Rogoff, two economics professors from Harvard, economic growth slows down an average of 1% when debt of countries with advanced economies reaches 90% of GDP. The US is projected to reach 100% shortly after 2020. This is probably a factor in the poor performance of the US economy in recent years. Another factor affecting the economy will be the decrease in corporate investing. Many people will move 401K investments out of riskier stocks and into money market accounts as they get older. We can expect cuts in government services and loss of government jobs. According to Rebecca Valenzuela, an Australian economist, there will be fewer goods since there will be fewer workers to produce them. She argues that this will result in people having to stop consuming certain goods and services. We can also very likely expect the government “official” debt to rise regardless of which political party controls the government. The poor economic conditions and depopulation will prevent the government from raising the necessary funds to support the growing numbers of elderly dependent on government assistance. The government will need therefore continue to borrow money. The future will have numerous economic problems.

So how do you prepare for economic collapse?

In my opinion you have to be financially capable to live on a minimum wage job. You have to be able to survive if you lose your job and can’t find anything better than a minimum wage job. If you find yourself living under a bridge and foraging for food in the woods, it will most likely be because you lost your job and couldn’t make ends meet and pay your rent, mortgage, or property taxes with a job that pays $8.00/hr. If you are able to get by on so little, then you will weather the coming economic storm better than those who are living above their means and lose their jobs. It would be wise to reduce your personal debt. It would eliminate concern about creditors repossessing your property. It will give you more ability to apply money towards other things. Relocating to a part of the country with a strong and diverse economy would be optimal. Diversity is important because when one financial sector is doing poor, another is usually doing well. You can further reduce your need for income by growing your own food. I would liquidate your IRA. I don’t think they will be there after economic chaos, inflation, and taxation ruin them. My wife and I liquidated our IRAs and applied the funds against our mortgage. Property, like precious metals, will keep value. I would be prepared to have family members move in with you. They will need help and may be able to provide help in weathering the storm. I think the most important prep will be to pray for God to guide you in your efforts to prepare for whatever calamity the future holds. God knows what is coming and what you will need, and I think He will guide and assist if you ask. These are the things I recommend to prepare for the coming demise.

Links:

Kotlikoff testimony: http://www.kotlikoff.net/sites/default/files/Kotlikoffbudgetcom2-25-2015.pdf

Gokhale Monograph: http://www.iea.org.uk/sites/default/files/publications/files/Gokhale-Interactive-PDF.pdf

Hummel monograph: http://econjwatch.org/articles/some-possible-consequences-of-a-us-government-default

Bloomberg article on default: http://www.bloomberg.com/news/articles/2013-10-07/a-u-s-default-seen-as-catastrophe-dwarfing-lehman-s-fall

Simon Johnson’s Slate article: http://www.slate.com/articles/business/project_syndicate/2011/07/what_if_the_government_defaults.html

NBC News default article: http://www.nbcnews.com/business/whats-worst-could-happen-7-debt-default-doomsday-scenarios-8c11366851

Economics on ageing population: https://www.economicshelp.org/blog/8950/society/impact-ageing-population-economy/

Economics of ageing population: http://www.economist.com/node/18651512

People have been saying the US is on course for an economic collapse for years; however, many of them have no formal education in economics, and almost all gain financially

Fences have their own usefulness that is readily apparent. In a suburban setting they are usually decorative, but in a grid-down scenario they could slow an attackers advance allowing you extra time to either retreat into your home, or effectively take care of them before they reach your house. Fences can also be augmented with concertina or razor wire if we do have a total collapse. This of course is only possible if you have the foresight to purchase the mounting hardware and supplies before the emergency happens and may fall into the category of “nice to have” for most people. Fences even without razor wire aren’t cheap.

Fences have their own usefulness that is readily apparent. In a suburban setting they are usually decorative, but in a grid-down scenario they could slow an attackers advance allowing you extra time to either retreat into your home, or effectively take care of them before they reach your house. Fences can also be augmented with concertina or razor wire if we do have a total collapse. This of course is only possible if you have the foresight to purchase the mounting hardware and supplies before the emergency happens and may fall into the category of “nice to have” for most people. Fences even without razor wire aren’t cheap.